VAT Posting Setups

Table of contents

Tax rates

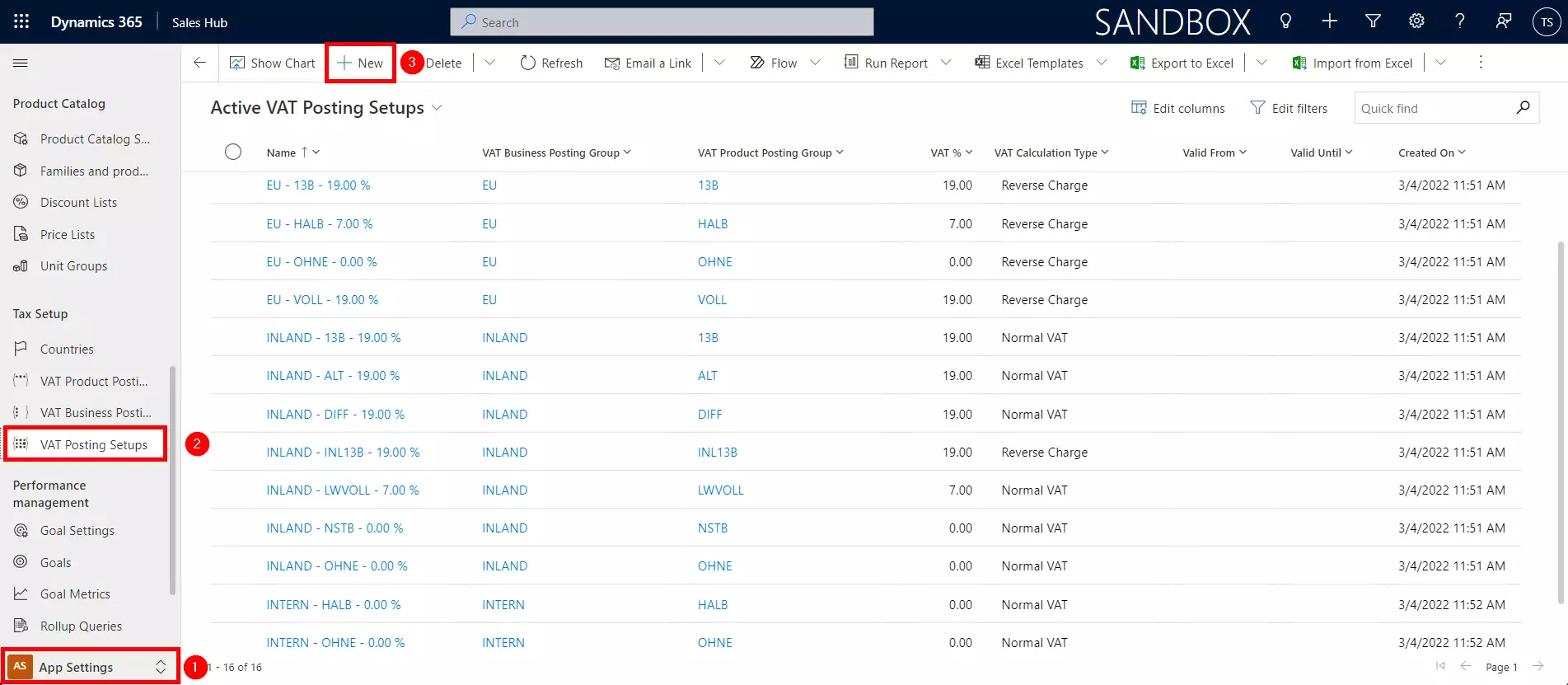

Once business posting groups and product posting groups are set up in Dynamics 365 Sales, the associated tax rate must be defined for all combinations of both properties. These combinations are stored in the table VAT Posting Setups.

To set up this table, navigate in the App Settings area (1) in the sitemap to the VAT Posting Setups (2) and click the New button (3).

To add a tax rate to a combination of business and product posting groups, fill in the following fields. You can also select a validity period. TRASER Sales 365 Tax will give you a message if necessary, should validity periods overlap.

| Column / Field | Description |

|---|---|

| VAT Business Posting Group | Select the previously set up VAT Business Posting Group. |

| VAT Product Posting Group | Select the previously set up VAT Product Posting Group. |

| VAT % | Define the tax rate resulting from the combination of business and product posting groups. |

| VAT Calculation Type | Select the calculation type from "Normal VAT" and "Reverse Charge" (for further explanation see Reverse Charge). |

| Valid From | Indicate when this tax rate is valid. |

| Valid Until | Indicate until when this tax rate is valid. |

Reverse Charge

The reverse charge procedure is a VAT regulation according to which, under certain conditions, it is not the service provider but the service recipient who owes the VAT and must pay it to his local tax office. Accordingly, quotes, orders, and invoices are reported without sales tax.

The prerequisites for this procedure from the perspective of a German company are, among others, that the recipient of the service is domiciled in the EU (Section 13b I UStG), or abroad (Section 13b II No. 1 UStG). The recipient of the service must also be a company or a legal entity under public law and must have a VAT identification number ("VAT" or "USt.-Id.").

Consequently, if the "Reverse Charge" calculation type has been set up in the VAT. If the "Reverse Charge" calculation type has been set up in the VAT Posting Setup, a check is made when creating a sales opportunity, quotation, order, or invoice line to see if a VAT number has been entered for the company in question. If this is the case, no VAT will be shown.